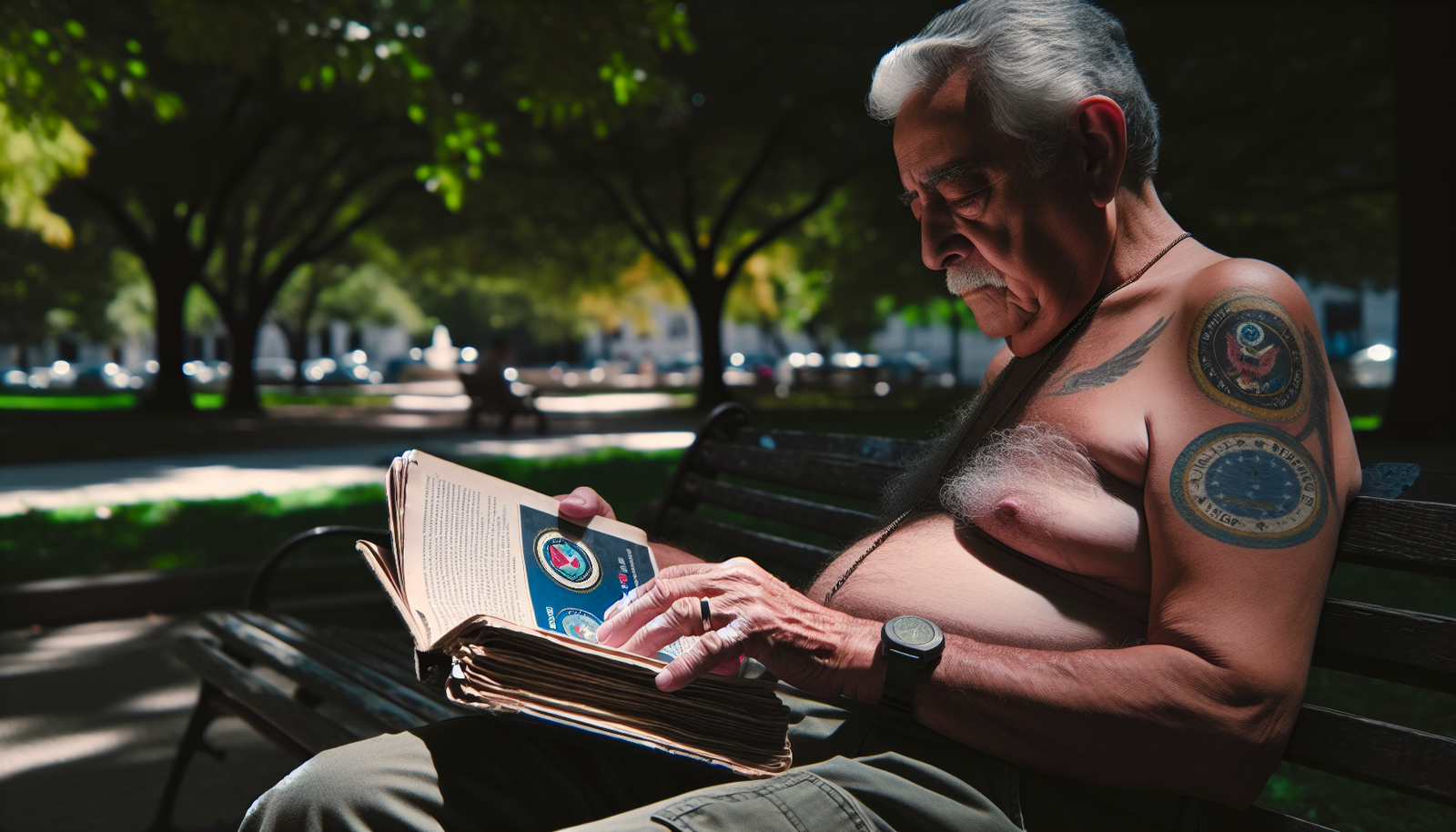

As you transition from a life of service in the military to the embrace of civilian existence, knowing how to tap into the retired military benefits you’ve earned becomes an essential roadmap to a secure future. “Navigating Retired Military Benefits: A Veteran’s Guide” is your beacon, shedding light on the often-complex landscape of post-service entitlements. Your tenacity and sacrifice don’t go unnoticed, and this guide ensures that you’re well-equipped with the necessary knowledge to claim healthcare, financial aid, and educational advantages. Here, you’ll discover how to weave through bureaucratic intricacies and leverage a wealth of resources, all tailored to help you forge a prosperous, civilian life while staying connected with comrades who share your distinguished legacy.

Understanding Retirement Benefits Eligibility

Criteria for Retirement Benefits

Before you can enjoy the sunset years of your life, it’s important to understand if you meet the criteria for retirement benefits. Generally, you are eligible if you’ve completed 20 years of active service, or if you’re medically retired. However, the specifics can vary by branch and circumstances, so it’s essential to check with your branch’s personnel office to get accurate information tailored to your service record.

Types of Military Retirements

There are several types of military retirements and it’s important to know which one applies to you. There’s the standard retirement for those who’ve served 20 or more years, Temporary Early Retirement Authority (TERA) for some who’ve served at least 15 but less than 20 years, and medical retirement for those unable to continue service due to medical reasons. Remember, the type you qualify for will affect the benefits you receive.

Understanding the Uniformed Services Former Spouses Protection Act

Navigating the financial aspects of a divorce can be tricky, especially when military pensions are involved. The Uniformed Services Former Spouses Protection Act allows state courts to distribute military retired pay to a former spouse as part of an approved divorce, property settlement, or alimony. Understanding this act is crucial if divorce is part of your personal history.

Navigating Defense Finance and Accounting Service (DFAS)

Setting up MyPay for Retired Military

To keep track of your finances and manage your pension effectively, setting up a MyPay account is key. MyPay is a DFAS service that allows you to view your Retiree Account Statement, make changes to your withholding and direct deposit information, and much more. Creating an account is simple and gives you a lot of control over your financials straight from your computer or smartphone.

Accessing Retiree Account Statements (RAS)

Your Retiree Account Statement (RAS) is like a bank statement for your military retirement pay. It details your pay rate, benefits, and withholdings. You can access your RAS through your MyPay account. It’s important to regularly review your RAS to ensure all information is accurate and up-to-date.

Updating Personal Information with DFAS

Life changes like marriage, divorce, or the birth of a child can affect your benefits. That’s why it’s so important to keep your personal information up-to-date with DFAS. Using MyPay or the DFAS website, you can easily update your information. Timely updates ensure you continue to receive your retirement benefits without interruption.

Exploring TRICARE Health Benefits

TRICARE Options for Retirees

As a retired service member, TRICARE continues to provide you with health benefits. You have multiple options depending on your needs, including TRICARE Prime, TRICARE Select, and for those eligible, TRICARE For Life. Each plan offers different levels of coverage, cost, and providers, so it’s important to choose the one that’s best for you and your family.

Enrollment and Eligibility

To receive health benefits under TRICARE, you need to enroll. Retirement from active duty makes you eligible for TRICARE coverage and you should enroll within 90 days of retirement to avoid a gap in coverage. Be sure to keep your and your family’s DEERS (Defense Enrollment Eligibility Reporting System) information current to maintain your TRICARE benefits.

Managing Your TRICARE Coverage

Life happens, and when it does, your healthcare needs may change. It’s a good idea to periodically review your TRICARE coverage to ensure it still suits your needs. You can manage your coverage online, make necessary changes during life events or during the annual open season, and always keep an eye on any changes in policy that may affect your benefits.

Accessing Veterans Affairs (VA) Services

Health Care Services for Veterans

The VA provides comprehensive health care services for veterans. This includes preventive care, treatment for injuries and illnesses related to service, specialized care for such things as PTSD or traumatic brain injury, and much more. If you haven’t already, be sure to enroll in VA health care to take advantage of these services.

Understanding Disability Compensation

If you’ve sustained an injury or have a condition that is service-connected, you may be eligible for VA disability compensation. The amount you’ll receive depends on the severity of your condition, which is measured in percentages. Applying for and understanding these benefits can significantly impact your quality of life, so it’s worth looking into.

Applying for VA Pensions

The VA provides pension benefits to wartime veterans who meet certain age or disability requirements and who have financial need. Applying for a VA pension involves submitting the necessary paperwork and proof of eligibility, such as discharge or separation papers, medical evidence, and financial statements.

Maximizing Your Military Pension

Calculating Retirement Pay

To estimate your retirement pay, you can use various calculators available online or consult DFAS. Several factors are considered in the calculation, including your length of service, rank at retirement, and the retirement system applicable to you. Understanding this calculation can help you plan your financial future more effectively.

Cost-of-Living Adjustments (COLA)

Cost-of-Living Adjustments, or COLA, are periodic increases in your retirement pay to counteract inflation. These adjustments are based on the Consumer Price Index and can make a significant difference in maintaining your purchasing power throughout retirement.

Survivor Benefit Plan (SBP) Explained

The Survivor Benefit Plan is an insurance plan that allows you to ensure a continuous lifetime annuity for your dependents after your death. It’s a decision made at retirement, and it’s a good idea to review it with your family and consider the impact it could have on their financial security.

Making the Most of Educational Benefits

Post-9/11 GI Bill

The Post-9/11 GI Bill provides generous education benefits, including tuition payments for higher education, a housing allowance, and a stipend for books and supplies. If you don’t use these benefits or have remaining entitlement, you might transfer them to your dependents.

Yellow Ribbon Program

If your education costs exceed the highest public in-state undergraduate tuition, the Yellow Ribbon Program can help. Participating institutions contribute additional funds without charging you, and the VA matches those amounts to cover the difference.

Utilizing Vocational Rehabilitation & Employment (VR&E)

The VR&E program assists veterans with service-connected disabilities to prepare for, find, and maintain employment. It offers resources for job training, employment accommodations, resume development, and job seeking skills coaching.

Utilizing Home Loan Guarantees

VA Home Loan Eligibility Requirements

The VA home loan is one of the most significant benefits, offering you the opportunity to purchase a home with no down payment and no private mortgage insurance. To be eligible, you need to meet certain service length requirements and obtain a Certificate of Eligibility.

Applying for a VA Loan

Applying for a VA loan is a process involving credit checks and approvals, not unlike applying for a conventional loan. However, the terms are typically more favorable, given the backing of the Department of Veterans Affairs.

Home Loan Benefits for Disabled Veterans

Disabled veterans may be eligible for additional benefits, including exemption from the VA funding fee and potential property tax reductions. It’s important to make these inquiries during the loan application process.

Employment Resources for Veterans

Career Transition Programs

The transition to civilian life can be challenging, especially where employment is concerned. Career transition programs provide support and guidance, helping you translate military skills to the civilian workforce and explore new career paths.

Federal Hiring Preferences for Veterans

As a veteran, you may receive preference points in federal hiring, giving you an advantage over other applicants. It’s a way to recognize your military service and can be beneficial in securing a federal job.

Veteran Entrepreneurship Programs

Starting your own business? Veteran entrepreneurship programs offer training, mentorship, and resources to help you start and grow your business. They recognize your unique skills and experiences as assets in the business world.

Mental Health and Counseling Services

VA Mental Health Support

The VA offers a range of mental health services, including counseling and therapy, for veterans dealing with issues like PTSD, depression, and anxiety. These services are confidential and tailored to meet the unique needs of veterans.

Military OneSource Counseling Services

For non-medical counseling, Military OneSource has you covered with twelve free counseling sessions per issue. It’s a fantastic resource for dealing with life transitions, stress, and personal matters.

Peer Support and Community Resources

Sometimes talking to someone who’s been in your shoes makes all the difference. Peer support groups and community resources can connect you with fellow veterans who understand the challenges you’re facing and can provide insight and solidarity.

Leveraging State-Specific Veteran Benefits

State Retirement Benefits for Veterans

Beyond federal benefits, most states offer additional retirement benefits for veterans, such as property tax exemptions, reduced rates for hunting and fishing licenses, and educational benefits for dependents. Be sure to inquire about these benefits with your state’s veterans affairs department.

Education Incentives Offered by States

Many states provide additional education incentives for veterans, like tuition waivers or scholarships. These can be used in conjunction with federal benefits to further reduce the cost of higher education.

Other State Resources and Assistance Programs

Each state has a wealth of resources and assistance programs designed to support veterans. These can range from employment services to mental health programs. Explore the offerings in your state to ensure you’re making the most of the benefits available to you.

Navigating retired military benefits doesn’t have to be a labyrinth. With a little guidance and the right resources, you can chart a course through them, ensuring you access every benefit you’ve earned through your service. Whether it’s understanding your retirement pay, maximizing your health benefits, or taking advantage of educational opportunities, you deserve to make the most of your retirement. As a veteran, these resources are your due, a token of gratitude from a nation you’ve served well. Use them, enjoy them, and here’s to your health and happiness in the years ahead!